- Quickbooks desktop payroll holiday pay how to#

- Quickbooks desktop payroll holiday pay full#

- Quickbooks desktop payroll holiday pay pro#

If you offer sick, holiday, or vacation pay, then you would need to add those categories to the table above. Not all liability insurance is based on payroll some of it may be based on your gross receipts. Your liability insurance is based on the rate your insurance carrier has given you for payroll. If you create your own table like the one above, and the employee has two or three classifications, then you would average those rates and use the average worker's comp rate in the table. The worker's compensation rate for each employee will vary depending on the classification or type of work the employee performs. Percentages in the second column are percentages of the hourly wage (the percentages for your locale may vary from the example here). The table below is an example of a more accurate assessment of true labor cost. Your total "labor burden" also includes payroll taxes, insurance, and employer-paid benefits like sick, vacation, holiday, and union benefits.

The hourly wage you pay for labor isn't your hourly cost.

Equipped with this calculation, a contractor can feel comfortable that they are calculating-accurately-what it costs to have employees on their payroll.

Quickbooks desktop payroll holiday pay how to#

The information here outlines exactly how to do that. One of the most important things to know about labor burden is how to calculate it. Labor burden is a subject that contractors need to get their arms around early on.

Quickbooks desktop payroll holiday pay pro#

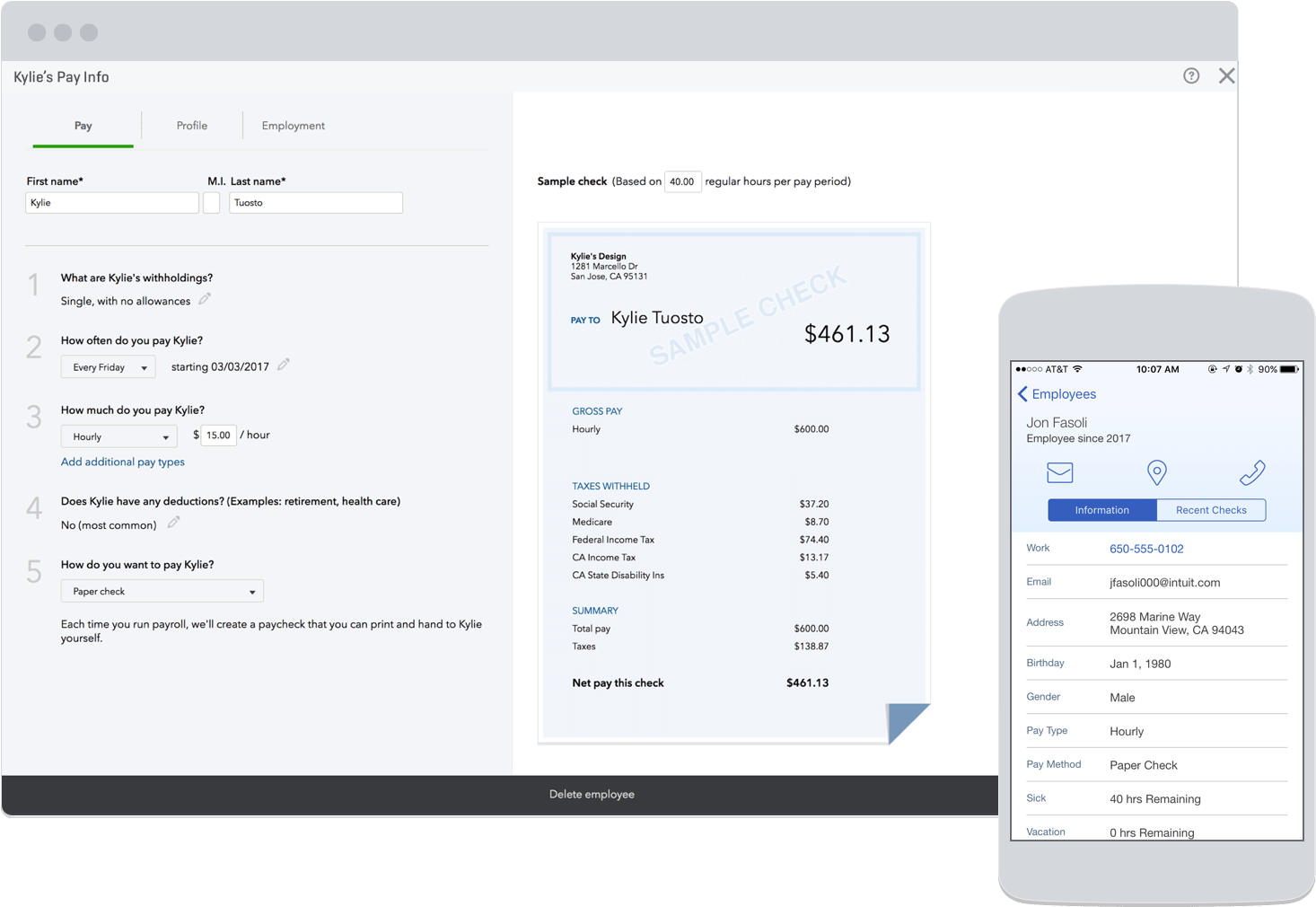

Employees will still get the same benefit of receiving their paycheck on time and accurately.QuickBooks Contractor - Calculating Labor Costsīy Karen Mitchell, author of Contractor's Guide to QuickBooks Pro 2002 The new 24-Hour Direct Deposit gives your clients the flexibility to run payroll when it’s right for their business and keeps them in control. 24 Hour Direct Deposit offers employers greater payday accuracy by ensuring employees are paid the correct amount on payday, even if there are last-minute adjustments that need to be made. Note, that the one-day processing does take into account bank working hours, including weekends and federal holidays. The funds don’t leave their account until they submit your payroll request, providing a little extra assurance on your business cash flow. Whether your clients run your payroll every Friday or at a set day each month, with 24-Hour Direct Deposit, they are able to hold onto your money for an extra day. The confirmation screen will display when the funds will be withdrawn from the employer’s bank account and deposited into the employee’s bank account. Just enter each employee’s details as you normally would, whether it is an hourly or salary worker. With the new one-day processing, users can submit a payroll request up until 5 p.m., PT, the day before payday.

Quickbooks desktop payroll holiday pay full#

Now, you can help them solve that problem by scheduling payroll up until the day before it runs.Īnnouncing Free 24-Hour Direct Deposit for QuickBooks® Online Payroll and QuickBooks Full Service Payroll! With 24 hour Direct Deposit, businesses now have the flexibility to pay employees by direct deposit sooner. Having to schedule payroll many days in advance can be problematic when your clients are tight on cash flow, creating a financial burden and time constraint to meet advance deadlines.

0 kommentar(er)

0 kommentar(er)